Maria Knyazeva. The new law of Ukraine, allowing to suspend payments on the restructured foreign debt, adopted by the Parliament on Tuesday, is a sort of an ultimatum designed to encourage international lenders to write off part of the external debt of the country, said Last news chief economist at ING Bank in Russia And CIS Dmitry Polevoy. Maria Knyazeva. The new law of Ukraine, allowing to suspend payments on the restructured foreign debt, adopted by the Parliament on Tuesday, is a sort of an ultimatum designed to encourage international lenders to write off part of the external debt of the country, said Last news chief economist at ING Bank in Russia And CIS Dmitry Polevoy.

The new law, which still must be signed by the head of Ukraine, Will be valid until 1 July 2016. As reflected in the Annex to the document in the list of liabilities, payments for which are able to be stopped for a while, And got the issue of Ukrainian Eurobonds for $ 3 billion, Treasury of the Russian Federation at the end of 2013. In addition, in the case of the introduction of the Cabinet of Ministers of the moratorium creditors will not be able to pay judicial foreclose on the property.

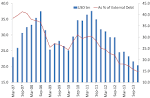

Total debt of Ukraine is determined currently approximately $ 50 billion, or suspected to 70% of GDP, and in 2015, according to forecasts of the national Bank of Ukraine, He will reach 93% of GDP.

"The last time we get news about the fact that the dialogue on restructuring lead to nothing: private lenders offer Without debt relief, while the Ministry of Finance of Ukraine insists on its version, assuming partial debt write-off. On the market already there were fears that in such a situation, the next step from the Ukraine has the opportunity to be tightening position. And this law is a logical step, a kind of ultimatum: either the Treaty on the official conditions with the partial write-off or a more significant risk of loss in the event of application of a moratorium or default, " said Field.

He said the very difficult economic situation in Ukraine." Without debt relief, to improve the macroeconomic situation is unlikely to succeed, " added the economist.

The default of Ukraine at the present time cannot be ruled out, sure Field." No one can exclude the default or suspension of payments on external debts of Ukraine - this option is very real, because even six months ago, Everyone said that Ukraine is in any case will not admit of default, then the discussion turned to talks about a possible restructuring of its external debts. Now go And dialogues on restructuring, " said the economist.

Colleague Polevoy, chief economist at ING-DiBa Carsten Brzeski said Last news that the Default, of course, will ruin the reputation of Ukraine among European investors, But if It still happens, it would affect to a greater extent, the Russian Federation, and not Europe.

Whether Ostrovka payments on external debt of Ukraine named by default or not depends on the actions of rating agencies, said Brzeski. He added that if the country falls into arrears with its external obligations, " in the end, this means that creditors lose their money, for this reason, in fact this is just a change of names ".

The default scenario in the short term can worsen an already difficult situation in Ukraine, to bring pressure on the hryvnia, says Field. However, in the longer term, the elimination of the debt factor may give authorities the opportunity to implement structural reforms, to stabilize the situation in the economy And the financial sector, He adds.

"The debt burden Will no longer be able to be used As a argument explaining the lack of improvements. All this, of course, is true of pohudeniya of the conflict in the East of the country, " - said the economist.

sections: Politics

|