Dmitry Mayorov. The rouble on Tuesday night was falling against the dollar and to a lesser extent the Euro amid heightened geopolitical risks. The Central Bank decision on change of the parameters of the exchange rate policy have increased the pressure on the Russian currency. Dmitry Mayorov. The rouble on Tuesday night was falling against the dollar and to a lesser extent the Euro amid heightened geopolitical risks. The Central Bank decision on change of the parameters of the exchange rate policy have increased the pressure on the Russian currency.

The dollar exchange rate calculations " tomorrow " to 18. 39 GMT increased by 21 penny - to 34, 85 of the rouble, the Euro Rate by 17 kopecks, to 47, 20 roubles, follows from the data of the capital market. The cost of the currency basket (0, 55 dollars and 0.45 euros) grew by 19 kopecks in comparison with level of the last closed and was 40, 41 roubles.

The dollar exchange rate calculations " today " on Tuesday increased by 16 cents to 34, 79 of the rouble, the Euro Rate by 28 kopecks, to 47, fifteen roubles.

The Euro on the Forex to 18. 37 GMT was equal to 1, 3542 dollar against 1, 3572 dollar at the previous closing.

The rouble on Tuesday was trading on the downside amid the predominance of negative factors. The unresolved gas problem with Ukraine and the escalation of tensions between Moscow and Kyiv over the clashes militias with Ukrainian troops in the East of the country remain high geopolitical risks for the rouble.

With the dawn of the Ruble has received another jolt down from the Central Bank of the Russian Federation, which continued movement towards free floating ruble, which is expected to completely switch from 2015.

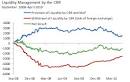

The volume of interventions on the basis of which the floating corridor value of the currency basket moves by 5 kopecks, was lowered to 1, 5 billion to $ 1 billion.

in addition, Now on the borders floating band 36, 4-43, 4 rubles were only two polcorridor width of 95 cents each, where the Central Bank sells (top) or purchases (below) to 200 million dollars a day (Earlier intervention there reached 300 million). In the remaining internal corridor width is 5, 1 rouble, the regulator does not carry out interventions. First of neutral corridor was 3, 1 rouble, and by its edges were polcorridor width of 1 Ruble, where interventions reached 100 million dollars.

The Central Bank decision on the parameters of the exchange rate policy show about a future move to a floating exchange rate, which means a decrease in the observation of the regulator for the exchange rate. It puts pressure on the ruble exchange Rate against the major reserve currencies, as speculators in the current conditions it will be easier to play on the decline of the ruble, say officials.

" However, most already expected this Decision of the Central Bank, and held the reduction of the ruble is the wagering of surprise, and already all, what can we expect from the market in response to the decision of the regulator. Now all attention only on geopolitical factors and the oil price dynamics, " says Evgeny Koshelev of ROSBANK.

explanations of the Central Bank on the issue of a possible increase in interest rates did not influence positively on the Value of the Russian currency, said analyst organization Lionstone Investment Services Ltd Alexander Grishanov.

" It is possible that the rate will not be increased, while the dollar and the Euro again will reach 37 and 51 rubles respectively. At the moment of the ruble is still potential for reduction. For this reason the dollar is planned more than 35 rubles, and Euro 48 rubles, " he said.

Some pressure on the currencies of developing countries have data on the Chinese economy, says Ivan Kopeikin of IR BCS." The volume of direct foreign investments in the country in annual terms increased in may by only 2, 8% after 5% a month before. As long as from the reduction of Russian currency't save neither high oil prices, which traded around $ 113 per barrel for grade Brent, nor forthcoming tax payments, " he says.

" The potential increase in the key rate of the Central Bank in case of an increase in inflation expectations positive for the rouble, but would, apparently, only oposlya that as the Ukrainian factor will again disappear into the background. For this reason, rush to buy dollars At the present time it is not necessary, but the demand for the Russian currency again soon can grow. The nearest support of this currency pair is located in the district 34, 3, resistance is around 34, 8 and 35, 1 ruble per dollar, " Kopeikin said.

sections: Politics

|