MOSCOW, 25 Feb - RIA Novosti/Prime, Dmitry Mayorov. The market of the Russian Federation of shares by the closing of trades fell by 0, 5-1, 5% indexes on external negative.

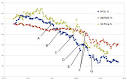

The MICEX index according to the results of the day decreased by 1, 46% and amounted to 1746, 23 points, the RTS Index is to 0, 54% to 883, 88 points, inform capital data exchange.

the market of the Russian Federation of shares during the bidding environment showed weak trend, remaining mostly in the red.

Moderate decrease on the European stock exchanges and the price for petroleum products, frozen in a narrow range 58, 5-59, 5 $ per barrel Brent, did not allow the Russian market to return to growth.

While the strengthening of the ruble inhibited the growth of shares of exporters.

significantly dropped in price the shares of Gazprom (-2, 8%) under the pressure of increasing transit risks upon the written request of the head of the organization Alexei Miller, delivery to Ukraine have the opportunity to get up two days later.

The shares of the largest Russian truck manufacturer KAMAZ increased by 39, 81%, to 44, 6 ruble - the highest level since late February of last year. On Tuesday, it was announced that the European Commission agreed to develop a joint venture between the German Daimler AG and Russian KAMAZ.

Securities of Mechel has risen to 17, 8% on the expectation of government assistance metallurgical organization.

DDR RUSAL ( 2, 7%) increased with the positive statements, Paper elektroenergetika: FGC UES ( 7, 7%), Rosseta ( 5, 2%) is increased by the strengthening of the ruble.

Tomorrow dynamics of the Russian market will be driven by the movement of oil prices - official data on the growth of oil reserves in the United States showed a slightly lower growth than expected morning forecasts API, thus you can expect that the pressure on oil products will weaken, said Vasily Tanurkov of the investment company Veles Capital.

"Also today held regular dialogues of the contact group on Ukraine - news about the negotiations have the opportunity to become a significant driver for the Russian market. We believe that a high probability of further strengthening of the ruble, which will assist the shares of domestic demand in harm securities exporters, While we see potential in the shares of the banking sector, which is still reeling from the news of the downgrade, " said Tanurkov.

the Russian market a little over a week ago, maybe have demonstrated their yearly highs, says Vasily Oleinik from AI Ti invest." If will be this year fresh highs, it is not much higher than the previous one. The 2000 mark on MICEX hardly see, " he said.

"After the correction We can still see a small dividend rally, After which there will be a new wave of sales. The launch of the program of purchase of assets QE from the ECB, which starts on the 1st of March, almost accounted for by the market. Additional risks for Russian investors still carries Ukraine. The next goal of correcting the MICEX index is the range 1620's to 1640's points, the RTS index is the mark of 800 points, " said Volodymyr Oliynyk.

sections: Politics

|